Are consumers ready for PSD2 (and SCA)?

In our previous articles, we mainly discussed what PSD2 and SCA will mean for businesses. However, all of these developments are and will continue impacting consumers and customer experiences in various ways. In this article, I’d like to shine a light on how these changes will affect consumers.

In a nutshell. the newly revised Payment Services Directive (PSD2) is aimed at improving financial data management. The European Union wants consumers to be in charge of their financial data. Alongside this noble intention, the aim is also to increase competition and foster innovation within the financial sector. Still, do consumers even know what is going on?

Do consumers know what is going on?

While banks and businesses will do their best to make the transition to PSD2 and SCA as smooth as possible, indeed, consumer awareness regarding the pending changes isn’t very high.

Some countries are trying their best to inform and prepare their citizens. In the summer of 2019, Banking & Payment Federation Ireland (BPFI) launched two awareness campaigns to alert consumers regarding the possible effects of PSD2 and SCA.

Across Europe, consumers also feel quite differently regarding the changes. For example, the Dutch consider safety when shopping online to be less important than other Europeans. Consequently, in the Netherlands, 52% of consumers are comfortable with sharing biometric data like fingerprints, compared to just 31 percent in the rest of Europe. Moreover, whereas the Dutch (50%) see speed and convenience as the most important factor when shopping online, the French (62%) and Germans (61%) feel online safety is the most important. Research by financial services provider GoCardless has shown this to be the case.

#1 PSD2 will improve the banking experience

As banks share customer data with FinTechs, expect to see an increase and improvement in mobile apps or online services geared towards financial management.

Soon, a customer with accounts at two or three different banks will be able to use a third-party app that sources information from these financial institutions. Third-party apps will also be allowed to manage the user’s bank accounts and make payments on their behalf.

For many consumers, PSD2 will lead to more choices in terms of services, better financial insights and easier financial management.

#2 PSD2 will deteriorate the online checkout experience

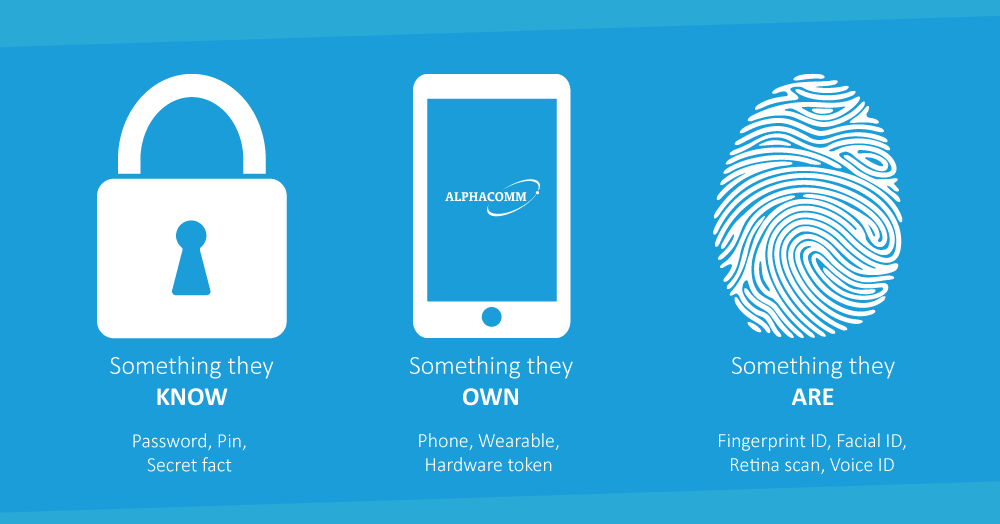

A critical part of PSD2 is the introduction of Strong Customer Authentication (SCA). This means that consumers will need to authenticate themselves at the checkout by presenting two of the three following elements:

● Something they know (passphrase)

● Something they own (devices)

● Something they are (biometrics)

An online shopper, after logging into the webshop with her password and proceeding to checkout, will be challenged by the bank to authenticate herself via something she owns or something she is. A previously quick checkout experience suddenly requires the user to take extra steps. In other words, SCA adds friction at checkout and in many cases, friction will lead to cart abandonment.

Still, some lucky businesses, granted they meet certain requirements, will be able to apply for exemptions and offer consumers frictionless flow

#3 PSD2 will increase privacy concerns

This is the big one. We’re living in an age in which consumers and their government representatives have become more aware of the dangers of data sharing. As with all matters of data sharing, there are many benefits to the consumer, but there’s always that risk of losing control. In the past, data has been shared, bought and sold with wanton abandon. Has the EU done enough to address these fears?

Personal financial data as price of admission?

Ideally, PSD2 opens up the market to allow new startups to launch innovative products that improve the lives of all consumers. Some of these companies will be very strict, adhere to all the rules and never try to gain an unfair advantage through the exploitation of data.

Still, there is also the fear that larger or less honest corporations that provide must-have goods or services, will leverage their popularity (power) in a way that consumers will find themselves handing over their data to gain access or receive discounts.

Here is a fictional example: what if a new version of the most popular mobile phone on the market would come at a €200 discount? In return, you’d need to grant access to your bank account, for the store to perform a credit check.

Or another one: what if a bigger, better and badder Game of Thrones sequel was only viewable through a popular streaming service’s ‘premium tier’? As a consumer, would you get a premium in order to watch the show everybody else can’t stop talking about?

There are benefits to the consumer. By analysing financial patterns alongside viewing patterns, they could indeed make better recommendations or even produce better shows. Is this worth it to you? Like it or not, it will definitely be worth it to many.

Complicated cross-border spats?

European consumers are increasingly shopping across the border. Many don’t always know where businesses are based. If something were to happen, taking (legal) action against a business in another European country other than your own might prove to be a very difficult challenge for most consumers.

Two degrees of separation?

Lastly, the more data consumers share, the less control they have over their privacy. It is even possible for one person’s lack of privacy to affect another person’s data. Even if a particular consumer is totally against sharing financial data, her data isn’t 100% private. Simply transferring funds to a friend, who does share financial data with third parties, can already be enough.

_______________________________________________

In conclusion, personal data, though aggregated and anonymized, can lead to serious consequences when in the wrong hands. However, it can also enrich society and improve the lives of millions in countless ways.

Luckily, companies that want to participate in this open banking system will need to undergo screenings, acquire permits from the central banks of the countries in which they want to operate in and be accountable to various local authorities.

At Alphacomm, integrity and security are values we hold dear. We have been fighting fraud and securing payments for over 20 years. Looking for advice on how to prepare for PSD2 and SCA? Get in touch with us today.

Questions? Get in touch!

For any additional information or inquiries related to PSD2 and SCA, feel free to contact us.

Let's make it happen!

Say Hello!

Address

Scheepmakerspassage 183

3011 VH Rotterdam

The Netherlands

Business

Follow us

Address

Scheepmakerspassage 183

3011 VH Rotterdam

The Netherlands

Business

Follow us

© Copyright Alphacomm B.V. | Made with <3 in Rotterdam